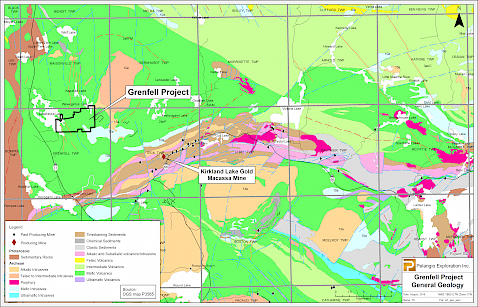

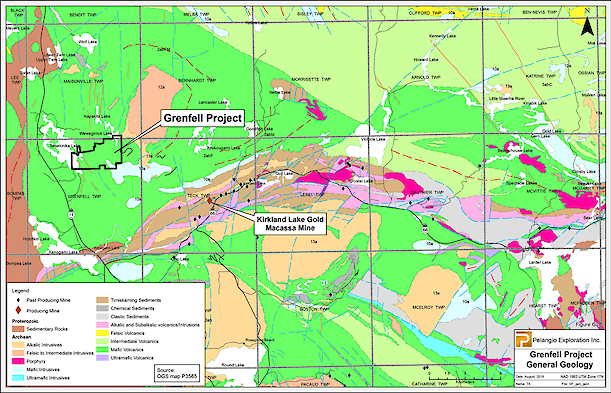

TORONTO, Ontario (February 6, 2020) – Pelangio Exploration Inc. (PX:TSX-V; OTC PINK:PGXPF) (“Pelangio” or the “Company”) is pleased to announce it has successfully completed a first phase drill program on its highly prospective Grenfell Property. The property is comprised of 38 mining cells and 8 leased claims covering an area of approximately 6.7 square kilometers (“km2”)and is located 10 km northwest of Kirkland Lake Gold’s Macassa mine (see Map 1. Grenfell Project Property Geology).

Ingrid Hibbard, President and CEO of Pelangio, commented, “In light of the rising gold price, we are very pleased to have completed our first phase of drilling and we are anxiously looking forward to the results in the very near future. Considerable historical exploration expenditures have been made on this property over many years by Kirkland Consolidated Gold Mines, John Sirola, Sedex Resources, and SGX Resources. These efforts demonstrate that this well-located project has excellent potential for hosting both narrow vein high-grade and bulk tonnage gold deposits.”

Current Surface Drill Program Focus

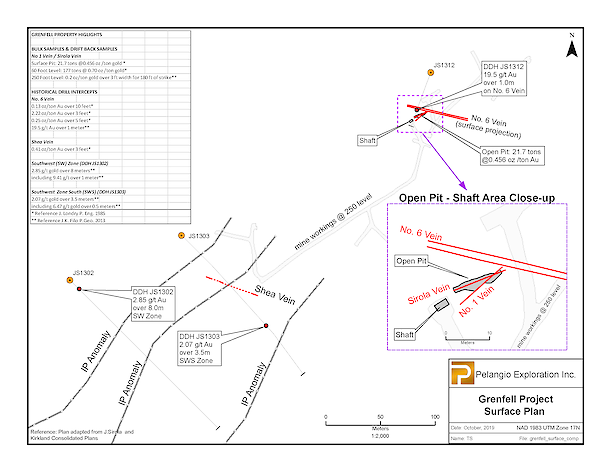

The recent drill program consisted of eight shallow drill holes (690 meters of drilling) to test a number of near surface targets known to exist from surface down to approximately 100 meters vertical (See Map 2. for target area reference). Details pertaining to the program are as follows:

- Holes JS2001 to JS2006 were drilled as fans from two drill pads to test the No.6 and No.1 veins and the bulk tonnage potential between the two transverse striking veins. Historical data has shown that both of these vein systems have significant high-grade gold associated with them and the proximal vein host rock between the veins demonstrated significant bulk tonnage potential. An example of the high-grade potential of the No.1 Vein is the historical surface bulk sample on the vein which returned 21.7 tons at 0.456 oz/ton gold. An example of the bulk tonnage potential associated with the No.6 and No.1 vein is historical hole JS955 which returned 2.62 g/t gold over 13.72 meters. A detailed summary of the historical work related to the No.6 and No.1 Veins is summarized below.

- Holes JS2007 and JS2008 were drilled to follow up on a single near surface intercept in Hole JS1302 which returned 2.85 g/t gold over 8 meters including higher grade intercepts of 4.09 g/t gold over 4 meters and 9.41 g/t gold over 1 meter. Details on this historical intercept are summarized below.

At present, drill core logging and sampling is well under way. It is anticipated that all results will be finalized and reported by the end of February 2020.

Grenfell Property Historic Data Summary

Gold mineralization was first discovered on the property in the early 1920's. From the early 1930's to about 1941, a series of major exploration campaigns were conducted; this work included 265 feet of shaft sinking, over 2000 feet of underground development on two levels, and a bulk sampling program to evaluate two of the vein systems. Exploration efforts ceased on the property during World War II. In 1985, a geological report was completed on the property by John Londry, P.Eng. (J. Londry, P.Eng., “Report on the John Sirola Property, Grenfell Township, 1985”), which documented the following points of interest on the various veins:

- The property hosts five distinct gold bearing zones. These zones in order of importance are the No.1 Vein, Sirola Vein, No. 6 Vein, Shea Vein and Shaft Vein.

- Significant work was conducted on the No.1 Vein and Sirola Vein. The Sirola Vein is interpreted to be a possible splay vein from the No.1 Vein. Two separate bulk samples from the Sirola Vein (surface pit) and No.1 Vein (60-foot level) returned 21.7 tons at 0.456 oz/ton gold and 177 tons at 0.70 oz/ton gold respectively. (see Sirola Vein surface sample picture Figure 1)

- The No.1 Vein was channel sampled along the drift on the 250-foot level which assayed 0.2 oz/ton gold across a 3-foot width for 180 feet of strike. The Londry report also stated that this drift should have continued in an easterly direction on the 250-foot level as values and vein structure suggested the vein continued.

- Londry's report states a third gold bearing zone, the No.6 Vein has a northwesterly trending strike orientation or a transverse strike relative to the No.1 Vein (southwest strike). The No.6 vein was drill tested with only three drill holes, these holes which returned 0.13 oz/ton gold over 10 feet, 2.22 oz/ton gold over 3 feet. and 0.25 oz/ton gold over 5 feet.

- The Shea Vein is also reported to be a northwesterly striking structure and is located approximately 700 feet southwest (“SW”) of the shaft collar. The 250-level drift was extended westward for 700 feet to evaluate the Shea Vein mineralization. Very limited data exists on this work, but Londry's report states a single historical drill hole on the Shea Vein returned 0.41 oz/ton gold over 3 feet.

- The Shaft Vein was intersected during the course of shaft sinking; the vein entered the shaft at the 90-foot level and exited the shaft at the 150-level. When diluted to a width of one foot, the Shaft Vein returned 0.24 oz/ton goldover the 60-foot interval it remained in the shaft.

Subsequent to Londry's work, a follow up drill program in 1987 was conducted by Neighbours Resources Inc. under the direction of Harry Dowaluck, F.G.A.C., Kirkland Lake Resident Geologist, Ministry of Northern Development and Mines. This program was focused on the No.1 Vein area. This program intersected a number of narrow high-grade intercepts but more importantly demonstrated some substantial potential for a near surface bulk tonnage zone. Some of the more representative intercepts from this program returned 0.075 oz/ton gold over 42 feet, 0.069 oz/ton over 39 feet and 0.049 oz/ton gold over 32 feet. (H. Dowaluck, B.A., F.G.A.C., Resident Geologist, “Summary Report on the John Sirola Property of Neighbours Resources Inc., 1988”).

In 1995, a limited drill program was conducted on the Grenfell property by Sedex Resources Inc. (“Sedex”) under the supervision of J. Kevin Filo, P.Geo. This program confirmed the potential of a near surface bulk tonnage zone documented by Dowaluck. Assay results in the immediate vicinity of the Shaft and No.1 Vein areas returned 2.60 g/t gold over 7.17 meters, 2.62 g/t gold over 13.72 meters and 1.77 g/t over 7.62 meters.

More recently, in 2012-2013, a property wide exploration program was conducted by SGX Resources Inc. (“SGX”) under the supervision of J. Kevin Filo, P.Geo. This program consisted of a compilation of historical data, and the completion of new geophysical and geochemical surveys. Upon completion of this work a preliminary phase of diamond drilling was conducted on various targets.

The SGX preliminary drill program resulted in the discovery of two new zones of mineralization and the presence of high-grade mineralization associated with the historic No. 6 Vein system. Approximately, 200 meters to the SW of the shaft two parallel NE-SW trending IP anomalies were drill tested; a single hole was completed in each anomaly. The first anomaly (SW Zone) returned 2.85 g/t gold over 8 meters including higher grade intercepts of 4.09 g/t gold over 4 meters and 9.41 g/t gold over 1 meter. The second anomaly (SW Zone South) returned 2.07 g/t gold over 3.5 meters including a higher-grade intersection of 6.47 g/t over 0.5 meters. Both IP anomalies associated with SW and SW South Zones remain untested for approximately 300 meters to the west.

SGX Resources also drilled a hole to test the historic northwest trending No.6 Vein on the 250-foot level. This hole returned a number of anomalous gold values along with a one-meter high grade intercept assaying 19.5 g/t gold.

The reader is cautioned that all of the aforementioned assay data is historical in nature. The corporation has relied on the work of other professionals, and the corporation has not conducted sufficient drilling or sampling to verify previous exploration data. Also, all drill intercepts are down-hole lengths and the true widths are unknown at this time.

The following reports are referenced with respect to the Sedex and SGX work stated above:

- “Geological Report on Mapping and Diamond Drilling on the Sirola Property, Grenfell Township, Northern Ontario for Sedex Mining”, by J. Kevin Filo, P.Geo., 1996

- “Assessment Report for the 2013 Diamond Drilling Program on the Grenfell Property for SGX Resources”, by J. Kevin Filo, P.Geo., 2013

Map 1. Grenfell Project General Geology

Map 2. Grenfell Project Surface Plan

Figure 1. Sirola Vein surface sample showing visible gold

Qualified Person

Mr. Kevin Filo, P.Geo. (Ontario), is a qualified person within the meaning of National Instrument 43-101. Mr. Filo approved the technical data disclosed in this release.

About Pelangio

Pelangio acquires and explores large land packages in world-class gold belts in Canada and Ghana, West Africa. In Canada, the company is focusing on the Dome West property located 800 metres from the Dome Mine in Timmins, the 25 km2 Birch Lake Property located in the Red Lake Mining District and the Dalton Property located 1.5 km from the Hollinger Mine in Timmins. In Ghana, the Company is focusing on two 100% owned camp-sized properties: the 100 km2 Manfo Property, the site of seven recent near-surface gold discoveries, and the 284 km2 Obuasi Property, located 4 km on strike and adjacent to AngloGold Ashanti’s prolific high-grade Obuasi Mine. Ghana is an English speaking, common law jurisdiction that is consistently ranked amongst the most favourable mining jurisdictions in Africa.

For additional information, please visit our website at www.pelangio.com, or contact:

Ingrid Hibbard, President and CEO

Tel: 905-336-3828 / Toll-free: 1-877-746-1632 / Email: info@pelangio.com

Forward Looking Statements

Certain statements herein may contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Forward-looking statements or information appear in a number of places and can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate” or “believes” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements and information include statements regarding the Company’s ability to complete the planned work programs, the Company’s strategy of acquiring large land packages in areas of sizeable gold mineralization, the Company’s plans to follow-up on previous work, and the Company’s exploration plans. With respect to forward-looking statements and information contained herein, we have made numerous assumptions, including assumptions about the state of the equity markets. Such forward-looking statements and information are subject to risks, uncertainties and other factors which may cause the Company’s actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statement or information. Such risks include the changes in equity markets, share price volatility, volatility of global and local economic climate, gold price volatility, political developments in Ghana, and Canada, increases in costs, exchange rate fluctuations, speculative nature of gold exploration, including the risk that favourable exploration results may not be obtained, and other risks involved in the gold exploration industry. See the Company’s annual and quarterly financial statements and management’s discussion and analysis for additional information on risks and uncertainties relating to the forward-looking statement and information. There can be no assurance that a forward-looking statement or information referenced herein will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements or information. Also, many of the factors are beyond the control of the Company. Accordingly, readers should not place undue reliance on forward- looking statements or information. We undertake no obligation to reissue or update any forward-looking statements or information except as required by law. All forward-looking statements and information herein are qualified by this cautionary statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.