TORONTO, Ontario (September 22, 2020) – Pelangio Exploration Inc. (PX:TSX-V; OTC PINK:PGXPF) (“Pelangio” or the “Company”) is pleased to announce that a phase 2 drill program has begun at its Grenfell gold project located 10 kilometers (“km”) northwest of Kirkland Lake Ontario. The phase 2 drill program is expected to run for about two weeks and assay results will be released thereafter.

HIGHLIGHTS

- The phase 1 drill program returned 314 g/t gold over 1.74 m (uncut) including a higher grade section which assayed 1810 g/t gold over 0.3 m in hole JS2004; as well as a broader gold intercept of 2.5 g/t gold over 26 m (including 9.39 g/t gold over 3m) in hole JS2005 (Reference Press Release March 1, 2020)

- The phase 2 drill program is designed to further test these results as well as test additional priority targets.

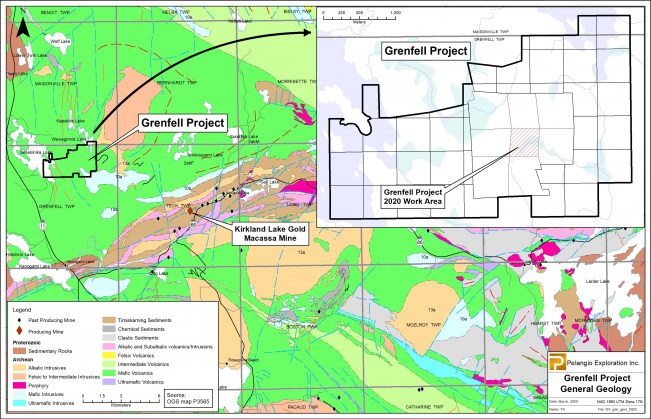

The Grenfell Gold Project is comprised of 38 mining cells and eight leased claims covering an area of approximately 6.7 km2, located 10 km northwest of the Town of Kirkland Lake Ontario (see Map 1, Grenfell Project Property Geology).

Following further analysis of the successful phase 1 March 2020 drilling program, a number of targets in the vicinity of the old mine workings have been prioritized for this drill program.

Ingrid Hibbard, President and CEO commented, “We are excited to begin the next phase of drilling at our Grenfell gold property. The success from our first drill program this spring is extremely encouraging and we are now further testing these highly prospective targets.

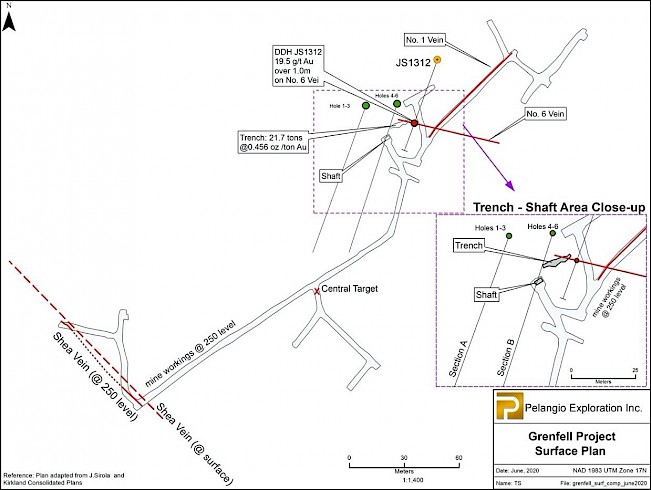

The priority targets (see Map 2) to be tested in the phase 2 program are as follows:

- Further evaluation of the strike extension of the northwesterly trending No.6 Vein system. Hole JS2004 returned 2.50 g/t gold over 26 m (including 9.39 g/t gold over 3 m) and hole JS2005 assayed 314 g/t gold over 1.74 m (uncut) in the spring 2020 drill program.

- Drill testing of the intersection of the No.6 Vein and No.1 Vein for a potential mineralized chute. Historical drifting and sampling on the 250 level of the former mine demonstrated that the No.1 Vein averaged 0.2 oz/ton gold over a width of 3 feet for a strike length of 180 feet. A surface bulk sample of 21.7 tons grading 0.456 oz/ton gold was extracted from a trench on the No.1 Vein.

- Very limited drilling is known to have been conducted on the No.1 Vein despite extremely encouraging sampling results as documented above. A hole is planned to confirm values on the higher grade portion of the No.1 Vein documented in the historical mine level plans.

- Historical mine plans on the 250 level have shown two other north northwesterly trending structures in a very similar orientation to the No.6 Vein (see Map 2). These structures have been designated as the Central Target and the Shea Vein. Mine plans and historical reports have documented significant gold mineralization associated with these structures. A historical hole on the Shea Vein returned 0.41 oz/ton gold over 3 feet. Drilling will be conducted on the two targets to test for both potential high grade mineralization as well as broad mineralized wall rock intercepts similar to that found on the No. 6 Vein.

Note: Historical intercepts quoted from a J. Londry P. Eng; Report on the John Sirola Property, Grenfell Township, 1985

The tables below represent location and noteworthy results from two significant holes completed in the spring 2020 drilling program.

GRENFELL DRILL HOLE LOCATION DATA

|

HOLE NO. |

EASTING |

NORTHING |

AZIMUTH |

DIP (Degrees) |

LENGTH (m) |

|

JS2004 |

560318 |

5336214 |

198 degrees |

-47 |

60.00 |

|

JS2005 |

560318 |

5336214 |

198 degrees |

-60 |

125.50

|

GRENFELL SIGNIFICANT ASSAY INTERCEPTS

|

HOLE NO. |

FROM |

TO |

METERS |

G/T Au |

G/T Au (CUT) |

G/T Au (UNCUT) |

|

** JS2004 |

14.00 |

15.00 |

1.00 |

3.73 |

|

|

|

|

|

|

|

|

|

|

|

** JS2004 |

19.00 |

45.00 |

26.00 |

2.50 |

|

|

|

includes |

26.00 |

45.00 |

19.00 |

3.18 |

|

|

|

|

29.00 |

45.00 |

16.00 |

3.23 |

|

|

|

|

37.50 |

45.00 |

7.50 |

4.81 |

|

|

|

|

37.50 |

40.50 |

3.00 |

9.39 |

|

|

|

|

|

|

|

|

|

|

|

** JS2005 |

33.00 |

59.00 |

26.00 |

|

1.32 |

|

|

|

33.00 |

59.00 |

26.00 |

|

|

21.80 |

|

Includes |

36.26 |

38.00 |

1.74 |

|

7.95 |

|

|

|

36.26 |

38.00 |

1.74 |

|

|

314.00 |

|

includes |

36.26 |

36.56 |

0.30 |

1810.00 |

|

|

Notes:

- **Denotes intervals reported in previous press release March 1, 2020

- Intervals shown as cut with high-grade assays over 34.28571 g/t Au were cut to 34.28571 g/t Au

- All intervals shown in the accompanying tables are core lengths as the estimated true width of the zone cannot be determined at this time

Map 1: Grenfell Project Property Geology

Map 2: Composite Surface and 250 Level Plan

Holes JS2004 and JS2005 are represented on the map as “Holes 4-6”

Quality Assurance/Quality Control

All core logging and sampling were conducted in a secure core logging facility in Timmins Ontario. Core logging and sampling of NQ diamond drill core was carried out by J.K. Filo P.Geo. Core logging and sampling adhered to 43-101 protocols and industry standard best practices. Each drill hole was sampled entirely and sample lengths varied from 0.26 meters to 1.5 meters maximum. Drill core was sawn in half with a diamond saw, tagged, and placed in securely sealed bags. Samples were transported to Actlabs facility in Timmins, Ontario by Pelangio personnel. Half of the core was retained for reference purposes.

Gold analysis was completed using a standard fire assay with a 50-gram charge with and atomic absorption (AA) finish (Actlabs 1A2-50 Procedure). Samples over 5 grams/ton were re-assayed by fire assay with a gravimetric finish. With each batch of 25 samples, one blank and one Oreas gold standard were submitted for analysis for QA/QC purposes. QA/QC samples were within acceptable tolerance levels. Full details on Actlabs analysis procedures and associated sample preparation can be reviewed on their web site.

Qualified Person

Mr. Kevin Filo, P.Geo. (Ontario), is a qualified person within the meaning of National Instrument 43-101. Mr. Filo approved the technical data disclosed in this release.

About Pelangio

Pelangio acquires and explores world-class gold belt land packages in Canada and Ghana, West Africa. Its key properties in Ontario, Canada, are the Grenfell property, located 10 km from Kirkland Lake, and the Dome West property, situated some 800 meters from the Dome Mine in Timmins. In Ghana, the Company is exploring its two 100% owned camp-sized properties: the 100 km2 Manfo Property, the site of seven near-surface gold discoveries, and the 284 km2 Obuasi Property, located 4 km on strike and adjacent to AngloGold Ashanti’s prolific high-grade Obuasi Mine. See www.pelangio.com for further detail on all Pelangio’s properties.

For additional information, please visit our website at www.pelangio.com, or contact:

Ingrid Hibbard, President and CEO

Tel: 905-336-3828 / Toll-free: 1-877-746-1632 / Email: info@pelangio.com

Forward Looking Statements

Certain statements herein may contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Forward-looking statements or information appear in a number of places and can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate” or “believes” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements and information include statements regarding the Company’s ability to complete the planned work programs, the Company’s strategy of acquiring large land packages in areas of sizeable gold mineralization, the Company’s plans to follow up on previous work, and the Company’s exploration plans. With respect to forward-looking statements and information contained herein, we have made numerous assumptions, including assumptions about the state of the equity markets. Such forward-looking statements and information are subject to risks, uncertainties and other factors which may cause the Company’s actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statement or information. Such risks include the changes in equity markets, share price volatility, volatility of global and local economic climate, gold price volatility, political developments in Ghana, and Canada, increases in costs, exchange rate fluctuations, speculative nature of gold exploration, including the risk that favourable exploration results may not be obtained, and other risks involved in the gold exploration industry. See the Company’s annual and quarterly financial statements and management’s discussion and analysis for additional information on risks and uncertainties relating to the forward-looking statement and information. There can be no assurance that a forward-looking statement or information referenced herein will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements or information. Also, many of the factors are beyond the control of the Company. Accordingly, readers should not place undue reliance on forward- looking statements or information. We undertake no obligation to reissue or update any forward-looking statements or information except as required by law. All forward-looking statements and information herein are qualified by this cautionary statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.