TORONTO, Ontario (September 10, 2018) – Pelangio Exploration Inc. (PX:TSX-V; OTC PINK:PGXPF) (“Pelangio” or the “Company”) is pleased to announce that it has entered into an option agreement to acquire a 100% interest in the mineral rights to all, or a portion of, 24 patented claims, located in Timmins, Ontario, (the “Dalton property”) from Rita Kean, the Estate of Jack Kean and the Estate of Glady McLellan (collectively the (“Kean Group”)) and 2522962 Ontario Inc. (“5SD Capital”).

Highlights of the Dalton Property:

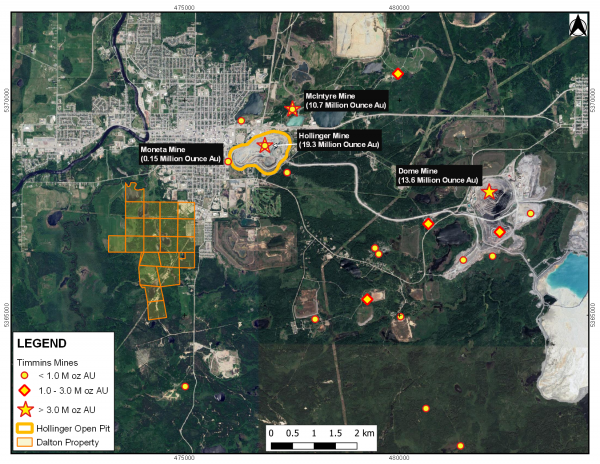

- Mineral rights to all, or a portion of, 24 patented claims, covering approximately 330 hectares (3.3 km2)

- Located in the Timmins - Porcupine mining camp, known to have produced over 70 million ounces of gold

- 1.5 km southwest of the Hollinger Open Pit project

“We are very excited about the Dalton property, and we are anxious to explore the potential of this property, located in the heart of the Timmins gold camp, only 1.5 km southwest of Goldcorp’s Hollinger Open Pit,” stated Ingrid Hibbard, President and CEO of Pelangio. “The legendary Hollinger mine has produced over 19 million ounces of gold since 1910.”

Geological Description

The Dalton Property is located in the Abitibi Greenstone Belt, the largest greenstone belt within the Canadian Shield. The Abitibi Greenstone Belt is the most prolific Archean terrain in terms of copper-zinc sulphide mineralization and gold mineralization. Major east and northeast trending faults (the Destor-Porcupine Deformation Zone and the Cadillac Deformation Zone) were active through the main period of volcanism. Over 120 million ounces of gold have been produced from mines associated with these two major structures in the Timmins, Kirkland Lake and Holloway gold camps. The Destor Porcupine fault is located approximately 2 km south of the property.

The property has an inventory of historical drill core which has been maintained in good order. A cursory observation of this drill core showed that numerous holes had significant alteration and sulphide mineralization was also observed. A substantial portion of the core was not assayed, and drill logs are unavailable. Pelangio intends to re-log and assay this core and confirm historical drill hole locations in the field for a very cost effective first phase of exploration.

Within the last few years, induced polarization surveys were completed on the property. Pelangio also intends to correlate the survey data with the recent historical drilling upon completion of re-logging and assaying to determine if further drilling is required on established targets or if some targets have not been fully evaluated.

The property has a number of old historical surface trenches and muck piles. Quartz veining and scheelite were observed in the historical surface workings, scheelite (a tungsten rich mineral) was a typical gangue mineral of the gold ores at the Hollinger mine. Additionally, as part of Pelangio’s first phase of work, Pelangio intends to re-sample any known mineralized zones as little information is currently available.

Terms of the Option Agreement and Work Commitment

In order to acquire a 100% interest in the Dalton Property, Pelangio must make the following cash payments and share issuances (90% to the Kean Group and 10% to 5SD Capital) and complete a total of $750,000 in exploration expenditures:

Share Issuance |

Cash Payments |

Work Commitment |

Year |

|

100,000 shares |

$15,000 |

$75,000 |

On the date the agreement is accepted by the TSXV |

|

100,000 shares |

$30,000 |

$150,000 |

On or before the first anniversary of the acceptance date |

|

100,000 shares |

$75,000 |

$225,000 |

On or before the second anniversary of the acceptance date |

|

100,000 shares |

$100,000 |

$300,000 |

On or before the third anniversary of the acceptance date |

|

400,000 shares |

$220,000 |

$750,000 |

|

Pursuant to the terms of the option agreement, Pelangio will be the operator on the project. Upon exercise of the option, Pelangio will grant the Kean Group and 5SD Capital a 3% Net Smelter Returns (NSR) Royalty, subject to the right to purchase a 1% NSR royalty for $1,000,000.

Pelangio’s proposed issuances to 5SD Capital pursuant to the option agreement are subject to prior TSXV acceptance. Ingrid Hibbard, the President and Chief Executive Officer of Pelangio, is also a shareholder of 5SD and accordingly is a Non- Arm’s Length Party for purposes of TSXV policies. However, the entry into the option agreement between Pelangio and 5SD Capital will not constitute a “related party transaction” for purposes of Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions.

Map #1: Location of the Dalton Property in relation to the Hollinger Open Pit project

Qualified Person

Warren Bates, P. Geo. (Ontario), is a Qualified Person within the meaning of National Instrument 43-101. Mr. Bates has verified and approved the data disclosed in this release.

About Pelangio

Pelangio successfully acquires and explores camp-sized land packages in world-class gold belts. The Company operates in both Canada and Ghana, West Africa, an English-speaking, common law jurisdiction that is consistently ranked amongst the most favourable mining jurisdictions in Africa. The Company is exploring three 100%-owned camp-sized properties: the 25km2 Birch Lake Property located adjacent to First Mining’s Springpole Gold Project, the 100 km2 Manfo Property, the site of seven recent near-surface gold discoveries, and the 284 km2 Obuasi Property, located 4 km on strike and adjacent to AngloGold Ashanti’s prolific high-grade Obuasi Mine.

For additional information, please visit our website at www.pelangio.com, or contact:

Ingrid Hibbard, President and CEO

Tel: 905-336-3828 / Toll-free: 1-877-746-1632 / Email: info@pelangio.com

Forward Looking Statements

Certain statements herein may contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Forward-looking statements or information appear in a number of places and can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate” or “believes” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements and information include statements regarding the Company’s potential acquisition of the Dalton Property, the Company’s strategy of acquiring large land packages in areas of sizable gold mineralization, the Company’s plans to follow-up on previous work, the issuance of the number of shares required to complete the exercise of the option to acquire the Dalton Property, the obtaining of TSXV acceptance of the proposed acquisition, and the Company’s exploration plans. With respect to forward-looking statements and information contained herein, we have made numerous assumptions, including assumptions about the state of the equity markets. Such forward-looking statements and information are subject to risks, uncertainties and other factors which may cause the Company’s actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statement or information. Such risks include the changes in equity markets, share price volatility, volatility of global and local economic climate, gold price volatility, , increases in costs, exchange rate fluctuations, speculative nature of gold exploration and other risks involved in the gold exploration industry, and in particular in relation to the Dalton Property, the risk that Pelangio might not obtain TSXV approval to proceed with the transaction, might not encounter favourable exploration results, might not fully-exercise its option to acquire the Dalton Property. See the Company’s annual and quarterly financial statements and management’s discussion and analysis for additional information on risks and uncertainties relating to the forward-looking statement and information. There can be no assurance that a forward-looking statement or information referenced herein will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements or information. Also, many of the factors are beyond the control of the Company. Accordingly, readers should not place undue reliance on forward-looking statements or information. We undertake no obligation to reissue or update any forward-looking statements or information except as required by law. All forward-looking statements and information herein are qualified by this cautionary statement.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.