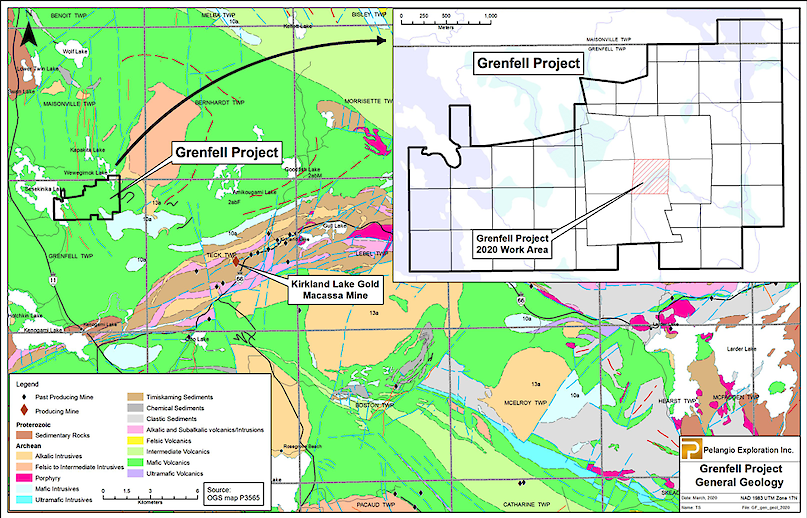

TORONTO, Ontario (March 9, 2020) – Pelangio Exploration Inc. (PX:TSX-V; OTC PINK:PGXPF) (“Pelangio” or the “Company”) has received assay results from holes JS2001 to JS2003, the final three holes of its eight-hole drill program completed on its Grenfell Property, located 10 kilometers from Kirkland Lake’s Macassa Mine, Ontario. (See Map 1)

Ingrid Hibbard, President and CEO of Pelangio commented; “We are pleased with our initial results which returned 314 g/t Au over 1.74 meters (uncut) in hole JS2005 as well as broad zones of near surface mineralization which returned 2.5 g/t Au over 26 meters in hole JS2004, although only sporadic gold intercepts were noted in holes JS2001 to JS2003. Further follow up of this very prospective zone, at depth and along strike, will be undertaken in the near future.”

Discussion of Recent Drill Program

The Grenfell property is comprised of 38 mining cells and 8 leased claims covering an area of approximately 6.7 square kilometers and is located 10 kilometers northwest of the Town of Kirkland Lake Ontario.

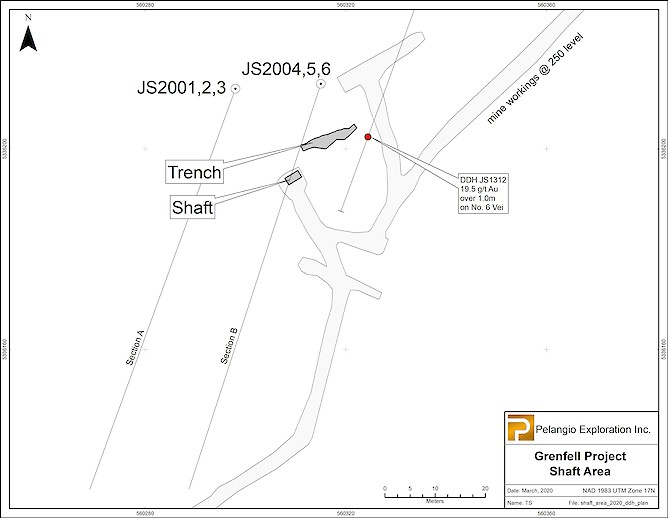

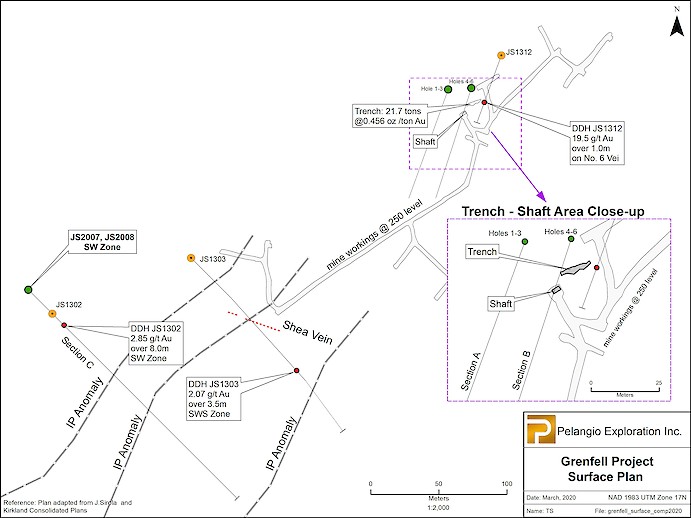

The recent drill program consisted of eight holes which evaluated two separate targets; the No.1/No.6 Vein/Structure in the vicinity of the historical shaft and the SW Zone. Six drill holes, JS2001 to JS2006 were drilled in the vicinity of the historical surface workings and shaft and two holes on the SW Zone (see Maps 2 and 3). Hole JS2001 to JS2003 and JS2004 to JS2006 were drilled as fans from two separate drill pads to test two transverse striking veins / structures designated in historical reports as the No.6 and No.1 Veins. (see Map 2 and 3)

Initial results to date on the No.6 Vein/Structure in holes JS2004 to JS2005 have confirmed the presence of broad near surface gold bearing zones associated with shorter intercepts of high-grade gold mineralization. Holes JS2001 to JS2003 intersected narrow sporadic intercepts of gold mineralization to the northwest of the JS2004 to JS2006 drill section. (see tables below)

Gold mineralization to date is associated with the hanging wall of a fault and diorite intrusive unit within the fault or proximal to it. The diorite intrusive is thought to represent the centre of the No.6 Vein/Structure referred to in historical reports.

At this time, the extent and shape of the gold bearing zone at depth and along strike is not well understood as a result of very limited and shallow drilling. Further drilling is required to determine the extent of mineralization along strike and at depth. Particular attention will be paid to the potential in the southeast where a single surface hole in 2013 on the No. 6 Vein/Structure returned a high-grade intercept of 19.5 g/t gold over one meter in association with a broad strongly anomalous zone over 10 meters. (Reference: SGX Drill Report by J.K.Filo, 2013)

As reported previously, no significant mineralization was intersected in holes JS2007 and JS2008 which were drilled to further evaluate a historical intercept on the SW zone (see Map 3).

All pertinent drill hole location data and significant assay data from the holes to date are presented in the accompanying Tables A and B.

TABLE A: DRILL HOLE LOCATION DATA

|

HOLE NO. |

EASTING |

NORTHING |

AZIMUTH |

DIP (Degrees) |

LENGTH (m) |

|

JS2001 |

560297 |

5336213 |

200 degrees |

-45 |

60.00 |

|

JS2002 |

560297 |

5336213 |

200 degrees |

-60 |

81.00 |

|

JS2003 |

560297 |

5336213 |

200 degrees |

-70 |

101.75 |

|

JS2004 |

560318 |

5336214 |

198 degrees |

-47 |

60.00 |

|

JS2005 |

560318 |

5336214 |

198 degrees |

-60 |

125.50 |

|

JS2006 |

560318 |

5336214 |

198 degrees |

-70 |

53.50 |

|

JS2007 |

559992 |

5336066 |

135 degrees |

-45 |

90.00 |

|

JS2008 |

559992 |

5336066 |

135 degrees |

-55 |

113.85 |

TABLE B: SIGNIFICANT ASSAY INTERCEPTS

|

HOLE NO. |

FROM |

TO |

METERS |

G/T Au |

G/T AU (CUT) |

G/T Au (UNCUT) |

|

JS2001 |

31.50 |

34.00 |

2.50 |

0.937 |

|

|

|

includes |

33.00 |

34.00 |

1.00 |

1.60 |

|

|

|

|

|

|

|

|

|

|

|

JS2001 |

54.50 |

55.00 |

0.50 |

2.45 |

|

|

|

|

58.50 |

59.50 |

1.00 |

1.05 |

|

|

|

|

|

|

|

|

|

|

|

JS2002 |

53.00 |

54.00 |

1.00 |

1.03 |

|

|

|

|

56.00 |

56.85 |

0.85 |

1.56 |

|

|

|

|

63.00 |

64.50 |

1.50 |

1.82 |

|

|

|

|

|

|

|

|

|

|

|

JS2003 |

57.00 |

58.50 |

1.50 |

1.06 |

|

|

|

|

|

|

|

|

|

|

|

**JS2004 |

14.00 |

15.00 |

1.00 |

3.73 |

|

|

|

|

|

|

|

|

|

|

|

**JS2004 |

19.00 |

45.00 |

26.00 |

2.50 |

|

|

|

includes |

26.00 |

45.00 |

19.00 |

3.18 |

|

|

|

|

29.00 |

45.00 |

16.00 |

3.23 |

|

|

|

|

37.50 |

45.00 |

7.50 |

4.81 |

|

|

|

|

37.50 |

40.50 |

3.00 |

9.39 |

|

|

|

|

|

|

|

|

|

|

|

**JS2005 |

33.00 |

59.00 |

26.00 |

|

1.32 |

|

|

|

33.00 |

59.00 |

26.00 |

|

|

21.80 |

|

Includes |

36.26 |

38.00 |

1.74 |

|

7.95 |

|

|

|

36.26 |

38.00 |

1.74 |

|

|

314.00 |

|

includes |

36.26 |

36.56 |

0.30 |

1810.00 |

|

|

|

|

|

|

|

|

|

|

|

**JS006 |

36.00 |

37.50 |

1.50 |

1.09 |

|

|

|

|

45.83 |

46.15 |

0.32 |

26.50 |

|

|

|

|

|

|

|

|

|

|

|

**JS007 |

|

|

|

NSV |

|

|

|

**JS008 |

|

|

|

NSV |

|

|

Notes:

i)**Denotes intervals reported in previous press release March 1, 2020.

ii) Intervals shown as cut with high-grade assays over 34.28571 g/t Au were cut to 34.28571 g/t Au.

iii) All intervals shown in the accompanying tables are core lengths as the estimated true width of the zone cannot be determined at this time.

Future Plans for Grenfell

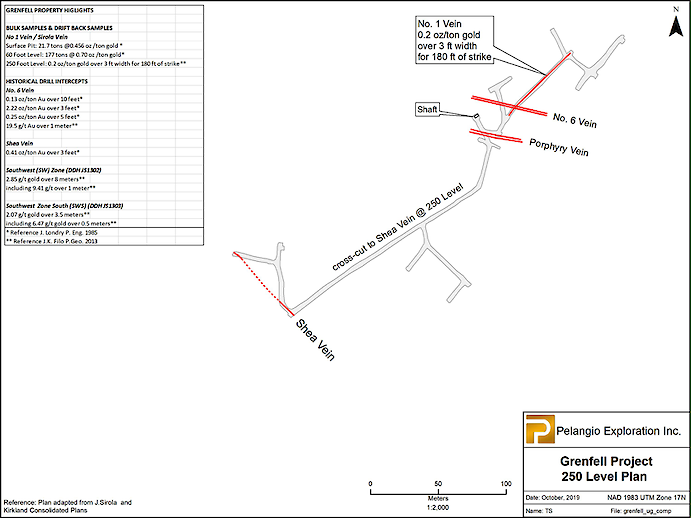

Further drilling will be conducted on the No.6 Vein/Structure to further evaluate the broad zones of mineralization and high-grade intercepts at depth and along strike to better define the extent of this zone. The Company will also consider some drilling to evaluate a similar parallel gold bearing northwesterly trending historical structure know as the Shea Vein approximately 200 meters southwest of the No 6 Vein/Structure. (Map 4) Further drilling is being considered for the No.1 vein as well above and below the 250-foot level workings which returned 0.2 oz/ton gold across a width of 3 feet for a strike length of 180 feet in a development drive on the 250 level (J. Londry, P.Eng., “Report on the John Sirola Property, Grenfell Township, 1985”)(see Map 4).

In addition, significant geophysical anomalies, some with coincident geochemical anomalies, remain to be tested.

Map 1. Grenfell Project Location and General Geology

Map 2 – Shaft Area

Map 3 – Grenfell Project Surface Plan

Map 4 – Grenfell Project 250 Level Plan

Quality Assurance/Quality Control

All core logging and sampling were conducted in a secure core logging facility in Timmins Ontario. Core logging and sampling of NQ diamond drill core was carried out by J.K. Filo P.Geo. Core logging and sampling adhered to 43-101 protocols and industry standard best practices. Each drill hole was sampled entirely and sample lengths varied from 0.26 meters to 1.5 meters maximum. Drill core was sawn in half with a diamond saw, tagged, and placed in securely sealed bags. Samples were transported to Actlabs facility in Timmins, Ontario by Pelangio personnel. Half of the core was retained for reference purposes.

Gold analysis was completed using a standard fire assay with a 50-gram charge with and atomic absorption (AA) finish (Actlabs 1A2-50 Procedure). Samples over 5 grams/ton were re-assayed by fire assay with a gravimetric finish. With each batch of 25 samples, one blank and one Oreas gold standard were submitted for analysis for QA/QC purposes. QA/QC samples were within acceptable tolerance levels. Full details on Actlabs analysis procedures and associated sample preparation can be reviewed on their web site.

Qualified Person

Mr. Kevin Filo, P.Geo. (Ontario), is a qualified person within the meaning of National Instrument 43-101. Mr. Filo and has reviewed and approved the technical data disclosed in this release.

About Pelangio

Pelangio acquires and explores large land packages in world-class gold belts in Canada and Ghana, West Africa. In Canada, the company is focusing on the 6.7 km2 Grenfell property located approximately 10 km from the Macassa Mine in Kirkland Lake, the Dome West property located 800 metres from the Dome Mine in Timmins, the 25 km2 Birch Lake Property located in the Red Lake Mining District and the Dalton Property located 1.5 km from the Hollinger Mine in Timmins. In Ghana, the Company is focusing on two 100% owned camp-sized properties: the 100 km2 Manfo Property, the site of seven recent near-surface gold discoveries, and the 284 km2 Obuasi Property, located 4 km on strike and adjacent to AngloGold Ashanti’s prolific high-grade Obuasi Mine. Ghana is an English speaking, common law jurisdiction that is consistently ranked amongst the most favourable mining jurisdictions in Africa.

For additional information, please visit our website at www.pelangio.com, or contact:

Ingrid Hibbard, President and CEO

Tel: 905-336-3828 / Toll-free: 1-877-746-1632 / Email: info@pelangio.com

Forward Looking Statements

Certain statements herein may contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Forward-looking statements or information appear in a number of places and can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate” or “believes” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements and information include statements regarding the Company’s ability to complete the planned work programs, the Company’s strategy of acquiring large land packages in areas of sizeable gold mineralization, the Company’s plans to follow-up on previous work, and the Company’s exploration plans. With respect to forward-looking statements and information contained herein, we have made numerous assumptions, including assumptions about the state of the equity markets. Such forward-looking statements and information are subject to risks, uncertainties and other factors which may cause the Company’s actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statement or information. Such risks include the changes in equity markets, share price volatility, volatility of global and local economic climate, gold price volatility, political developments in Ghana and Canada, increases in costs, exchange rate fluctuations, speculative nature of gold exploration, including the risk that favourable exploration results may not be obtained, and other risks involved in the gold exploration industry. See the Company’s annual and quarterly financial statements and management’s discussion and analysis for additional information on risks and uncertainties relating to the forward-looking statement and information. There can be no assurance that a forward-looking statement or information referenced herein will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements or information. Also, many of the factors are beyond the control of the Company. Accordingly, readers should not place undue reliance on forward- looking statements or information. We undertake no obligation to reissue or update any forward-looking statements or information except as required by law. All forward-looking statements and information herein are qualified by this cautionary statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.